Learn more about

the Inflation Reduction Act

Everything you need to know about the IRA and Mosaic

What is the Inflation Reduction Act?

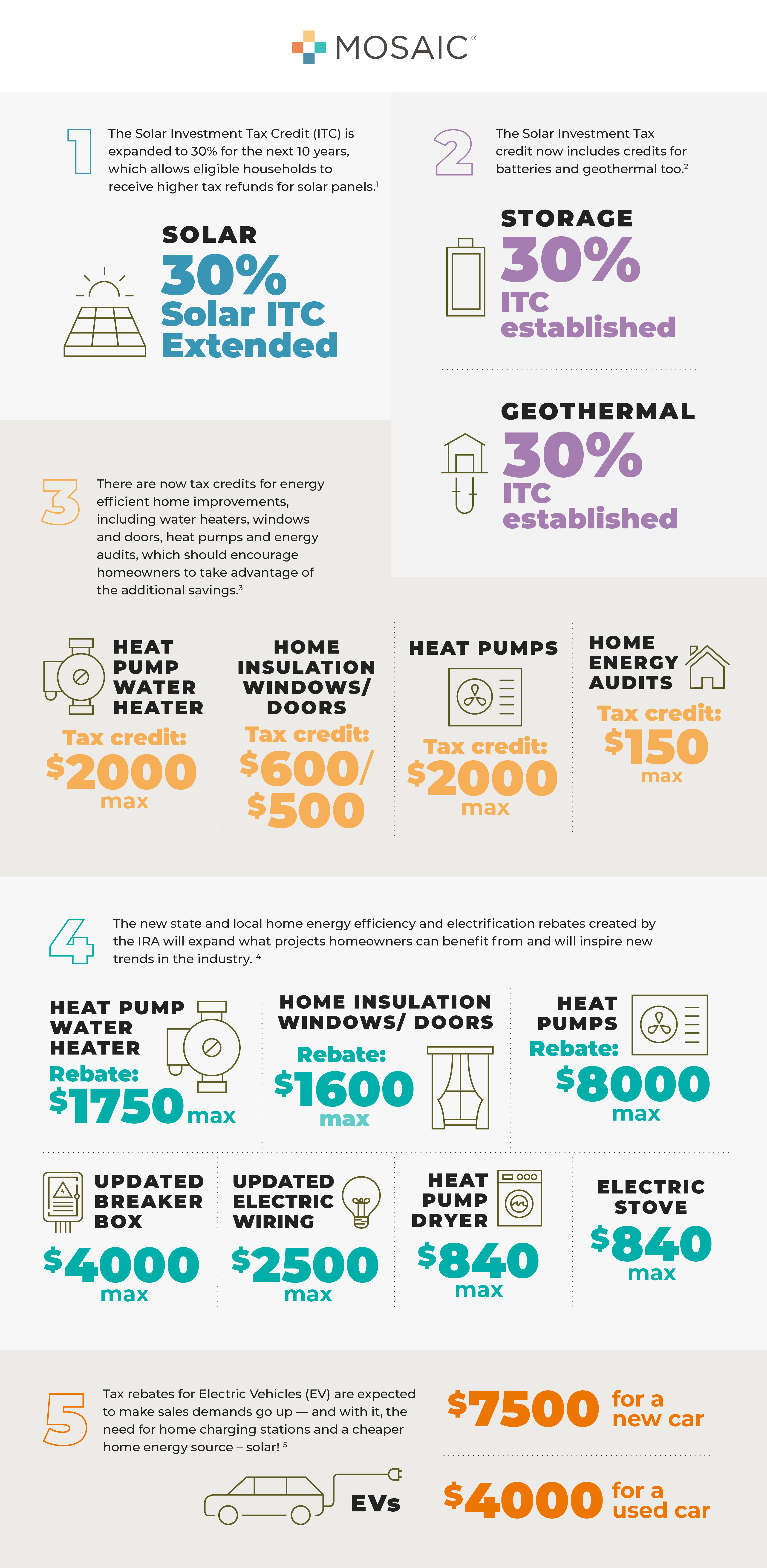

The Inflation Reduction Act, or IRA, is the largest clean energy legislation ever passed in the United States. Effective Jan 1, 2023, its tax credits and rebates make upgrades like solar panels, heating and cooling systems and energy efficient improvements accessible to more households. Contractors are essential in maximizing these benefits and helping more homeowners transition to cost-saving clean energy alternatives. That’s why we’ve teamed up with Rewiring America on an education coalition to spread the word on what the Inflation Reduction Act can offer.

Included below are some helpful resources to get you started:

- Webinar and FAQ for solar installation professionals

- Webinar and FAQ for home improvement contractors

- Downloadable infographic – 5 ways the IRA will benefit homeowners

- Rewiring America’s IRA savings calculator, fact sheets and guide

Join Ari Matusiak (CEO of Rewiring America and co-founder and managing partner of Purpose Venture Group) and Patrick Moore (COO of Mosaic) for two informative sessions on the Inflation Reduction Act and what it means for you and your customers.

Webinar for solar installation professionals

Webinar for home improvement contractors

3-Step Conversation Checklist

for the Inflation Reduction Act

The Inflation Reduction Act incentives are a great opportunity for contractors to close more and bigger deals. Here’s a quick checklist to help you start the IRA conversation with your homeowner customers.

Step one: Start with the savings possibilities

- Use our IRA infographic to explain what rebates and tax credits are available for the project.

- Help homeowners understand how these incentives can lower their overall project cost.

Step two: Don’t forget to mention regulations

- The IRA incentives are available to most, but there are limitations. Take some time to become familiar with these exclusions so you don’t mislead your customers.

- Refer customers to the Rewiring America calculator to see what they might be able to qualify for.

- Make sure your customers understand that no tax credit or rebate is 100% guaranteed. Recommend they find a tax professional to help them understand all of the specific financial details.

Step three: Help plan projects

- Highlight other projects that have IRA savings to encourage customers to start new projects and benefit from more savings.

- Use financing options to make projects even more affordable and maximize customer savings.

This document does not constitute professional tax advice. It should not be used as the only source of information when making purchasing decisions related to residential energy or for tax filing. Consult a tax professional to determine what makes sense for you.

The Inflation Reduction Act’s tax credits and rebates will allow more households to prosper from sustainable home improvements. Homeowners who understand the law’s economic benefits are more likely to take on new — and higher-ticket — projects.

As a contractor, make sure you work the IRA incentives into your sales pitch to close more deals and help homeowners navigate their possible savings.

The infographic below outlines basic information on the incentives. This is just a starting point. Homeowners should always consult resources like tax professionals to gain more insight into how they can best benefit.

1. retroactive to Jan. 1, 2022. 2. retroactive to Jan. 1, 2022. 3. For one taxable year, the credit cannot exceed $1,200 for the amount paid for energy efficiency improvements installed. The cap increases to $2,000 for electric or high-efficiency natural gas heat pumps and heat pump water heaters, $600 for windows, $500 for doors, and $150 for Home energy audits. There are no income restrictions on these tax credits. These tax credits will start in 2023. 4. Maximum rebates available will vary by state and by income level. Incentives may be additive, depending on rebate programs and rebates are available on a first-come-first-served basis starting January 2023. 5. Rebates subject to adjustments.

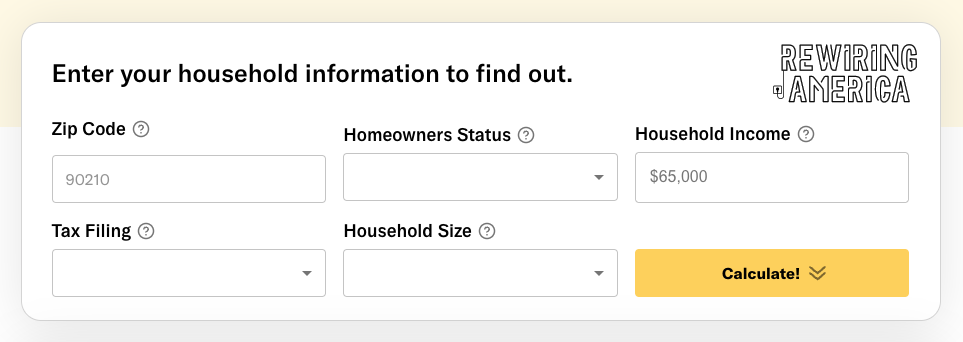

Explore the Rewiring America IRA savings calculator, fact sheets & more

How much money can your homeowner customers qualify for with the Inflation Reduction Act?

Help your customers understand how the IRA can help them improve and electrify their home, by swapping out older, less-efficient technologies for newer electric ones. Click the button below and share this helpful savings calculator with your customers.

The Rewiring America

IRA fact sheets

Get important information on High-Efficiency Electric Home Rebate programs, 25C and 25D residential tax credits, as well as what the Inflation Reduction Act means for contractors, electrification and more.

The Rewiring America

Guide to the IRA

The Inflation Reduction Act is full of incentives to help your homeowner customers go electric. Help them get more information on maximizing savings, find equipment overviews, case studies, a checklist and more.