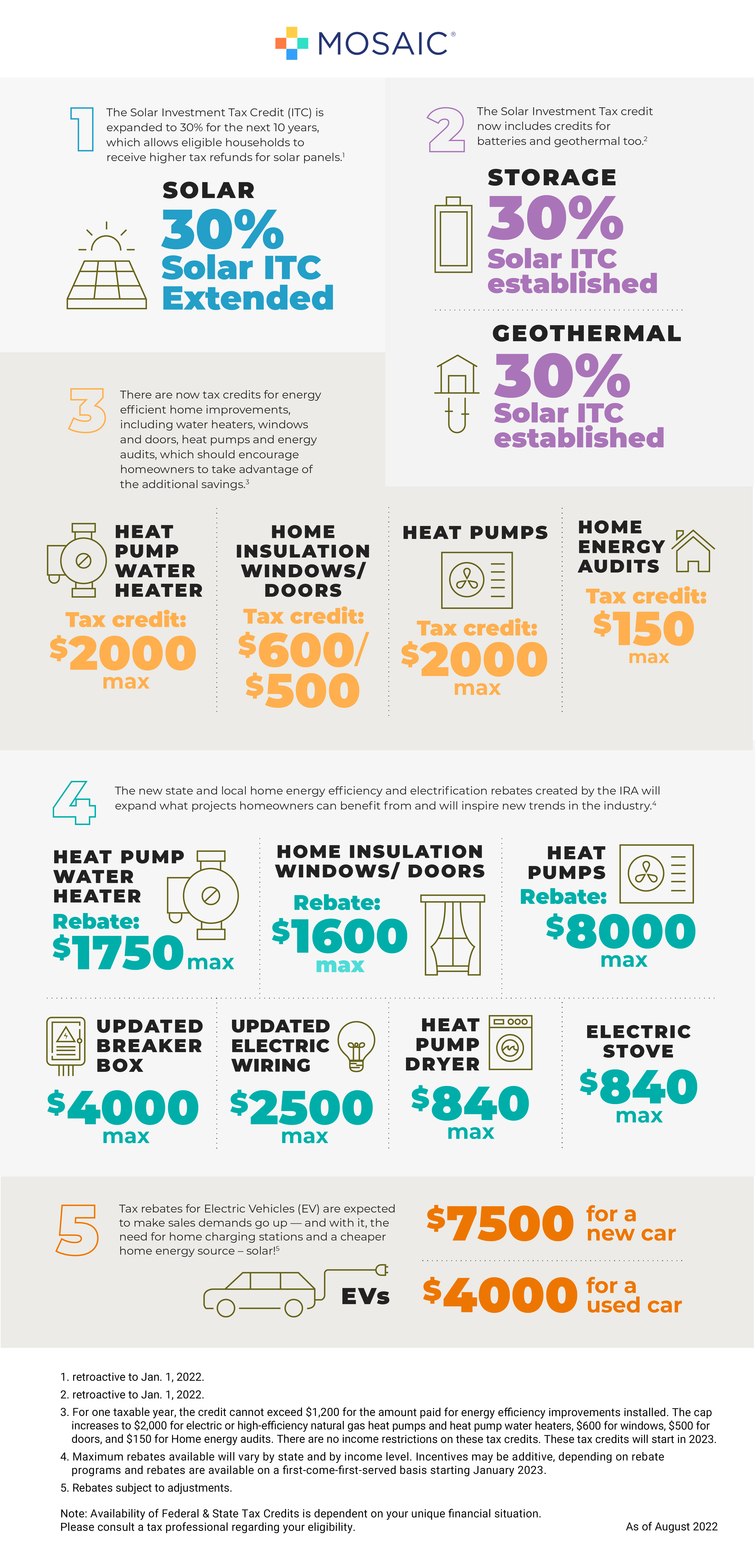

The Inflation Reduction Act’s tax credits and rebates will allow more households to prosper from sustainable home improvements. Homeowners who understand the law’s economic benefits are more likely to take on new — and higher-ticket projects. As a contractor, make sure you work the IRA incentives into your sales pitch and help homeowners navigate their possible savings.

The infographic below outlines basic information on the incentives. This is just a starting point. Homeowners should always consult resources such as the Rewiring America IRA calculator and tax professionals to gain more insight into how they can best benefit.

1. retroactive to Jan. 1, 2022. 2. retroactive to Jan. 1, 2022. 3. For one taxable year, the credit cannot exceed $1,200 for the amount paid for energy efficiency improvements installed. The cap increases to $2,000 for electric or high-efficiency natural gas heat pumps and heat pump water heaters, $600 for windows, $500 for doors, and $150 for Home energy audits. There are no income restrictions on these tax credits. These tax credits will start in 2023. 4. Maximum rebates available will vary by state and by income level. Incentives may be additive, depending on rebate programs and rebates are available on a first-come-first-served basis starting January 2023. 5. Rebates subject to adjustments.