Having an effective sales process is at the core of your success as a contractor, and chances are you’ve made a few (or many) changes to it over the years. In addition to learning what works and what doesn’t, you’ve got to dial in changing homeowner expectations along with emerging new opportunities as the home improvement industry evolves.

Mosaic has built our home improvement financing platform to be as flexible and intuitive as possible so that it fits seamlessly into your existing process regardless of how you currently sell. But it also gives you the option of a new and potentially game-changing way to integrate the availability of financing options into your process: as a sales tool, not just a closing tool.

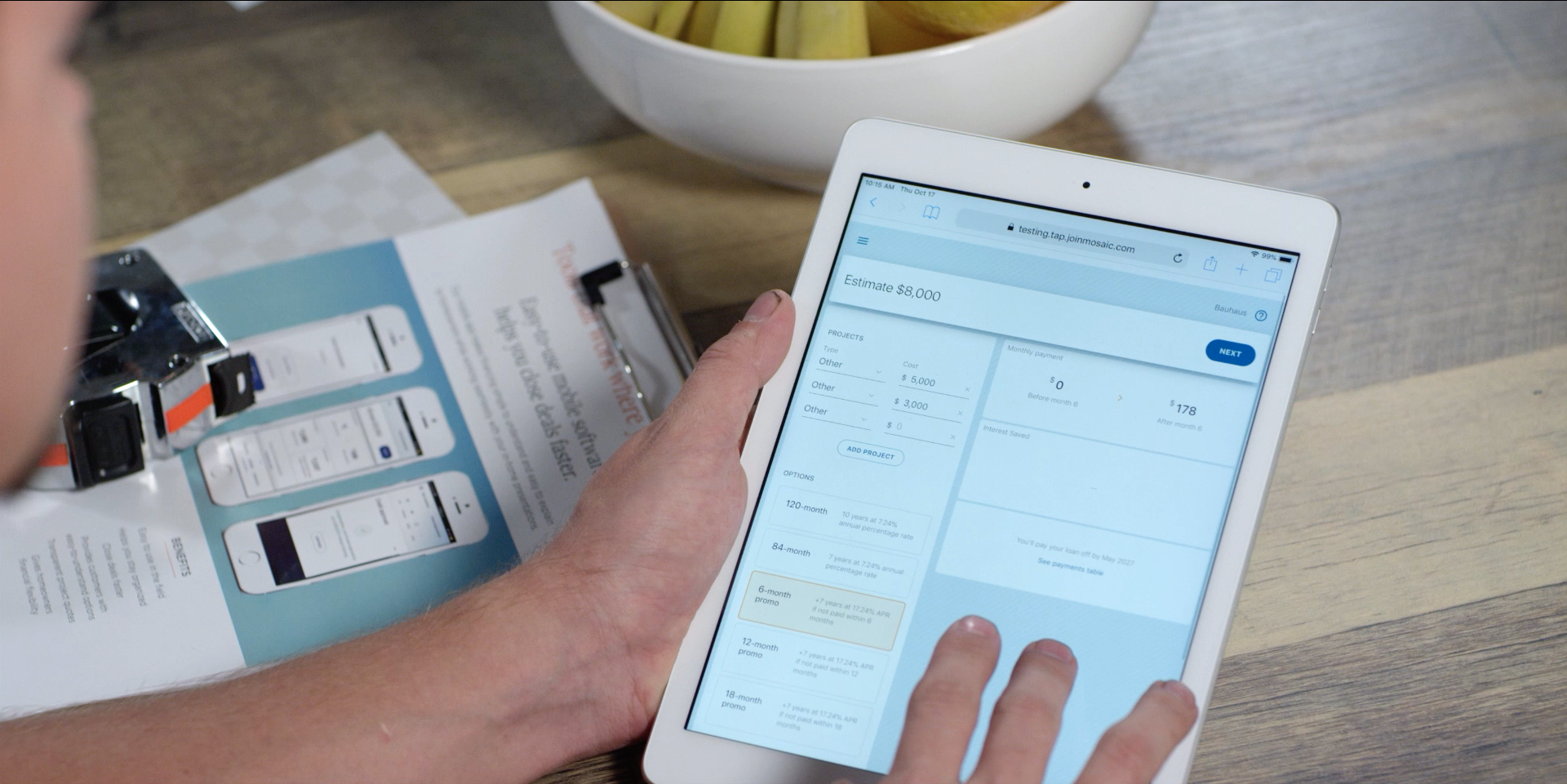

Let’s take a look at how the pre-approval for home improvement loans option offered in the Mosaic point-of-sale app lets you insert the availability of financing options into the conversation sooner – and close bigger deals with happier and more satisfied customers.

How Pre-Approval Works

In many sales processes, the topic of financing is often introduced when you’re closing. In other words, you’ve already settled on a scope of work and a cost estimate, and now it’s time to figure out how to pay for it. This makes sense, but at the same time it makes the conversation potentially stressful – after all, the fate of the project you’ve already planned is at stake, and in a typical loan application process your customer may face a ‘hard’ credit check that could impact their credit score.

The pre-approval for home improvement loans feature available through the Mosaic platform lets you flip this process on its head and lead with financing in a much less stressful way. This means no risk and major benefits for both you and your customer. Here’s how it works:

- With your customer’s permission, you send them a text message that allows them to connect to Mosaic’s secure financing portal.

- Your customer enters their social security number, date of birth, and annual income – privately, without having to give you any information.

- The homeowner receives an instant credit evaluation with a soft credit check that does not impact their credit score.

- Approved homeowners are presented with a pre-approved maximum loan amount, along with a menu of term and pricing options, preselected by your company based on which you’ve opted to make available.

Mike O’Connell of Mosaic’s sales team recommends introducing this option early on and emphasizing the fact that the soft credit check makes this a no-risk process. For example, he says, a contractor might say to their customer: “Many customers like to look at loan financing options they are pre-approved for at no risk to their credit. If you’re comfortable, I just need you to respond YES to a text message to look at those options.” Allowing the customer to verify their identity and details on their own phone adds a layer of security and comfort.

It’s a fast, easy process, but it can completely transform your sales conversation. First, being able to know whether financing will be available without having to risk a hard credit pull eliminates a major potential stress point right upfront. That additional comfort level alone can go a long way towards establishing trust and rapport with homeowners.

But that’s not all.

How Pre-Approval Changes the Conversation

Pre-approvals for a home improvement loan also changes a customer’s fundamental ask, from “what home improvements do I think I might be able to afford?” to “what home improvements do I want, now that I know more about what level of financing is available to me?”

For example, imagine visiting a homeowner that wants a roof replacement – but they’re also complaining about gutters that get clogged every fall. You’ve given a ballpark estimate of $20,000 for the roof, but your customer has been pre-approved through Mosaic for up to $55,000 in financing. Now, you have an opportunity to discuss the benefits of adding gutter guards – or even the designer shingles your customer was admiring – with confidence that sufficient financing is available.

Introducing financing options has another benefit for you and your customer: it changes the conversation from the total price tag to monthly payments, thanks to the simple interest rate loans offered through Mosaic. In this example, you can present the oversized gutters as an additional $20 a month, instead of adding $2,000 to the cost. This gives your customers a more realistic expectation for what this project will mean for their monthly budget and mirrors the familiar experience of looking at monthly mortgage payments when they first bought their house.

Larger ticket sizes and commissions are great for contractors too, of course! But first and foremost, this type of sales process is about maximizing your customer’s satisfaction. It allows them to choose the home improvements that they want, with a more accurate idea of how they’ll pay for it, and all through a secure process they can trust. This kind of great customer experience generates return customers, glowing reviews, and referrals, making it a true win-win for both of you.

*Home Improvement Loans through the Mosaic Platform are made by WebBank, Member FDIC, Equal Housing Lender.