Home battery storage is currently a small part of the overall home solar market, but it’s growing fast. According to the most recent data from GTM Research, the market for residential storage grew over 200% in 2017 compared to 2016. And, thanks to news from the IRS, that growth could accelerate even more. Earlier this month, the agency published a letter that could open a pathway for homeowners to claim the 30% Residential Renewable Energy Tax Credit for home batteries added to existing home solar power systems.

According to GTM, increased adoption of batteries by existing solar homes could quadruple the total residential battery installations to date. It’s an exciting opportunity to potentially supercharge the market for home battery systems — but the news comes with two caveats that both installers and homeowners need to be aware of.

100% Solar Charging

First, it’s important to understand that this is not a separate tax credit for batteries specifically — it’s an application of the existing home solar tax credit to a connected battery system. According to the underlying law, the tax credit defines a “qualified solar electric property” as “property which uses solar energy to generate electricity for use in a dwelling unit located in the United States and used as a residence by the taxpayer.”

In its newest letter, the IRS affirms that batteries are included under this definition — if the battery system charges only with electricity from solar panels, and not from the grid. You don’t need to be a lawyer to understand it: if a battery is charging from the grid, it is no longer exclusively part of your home solar system.

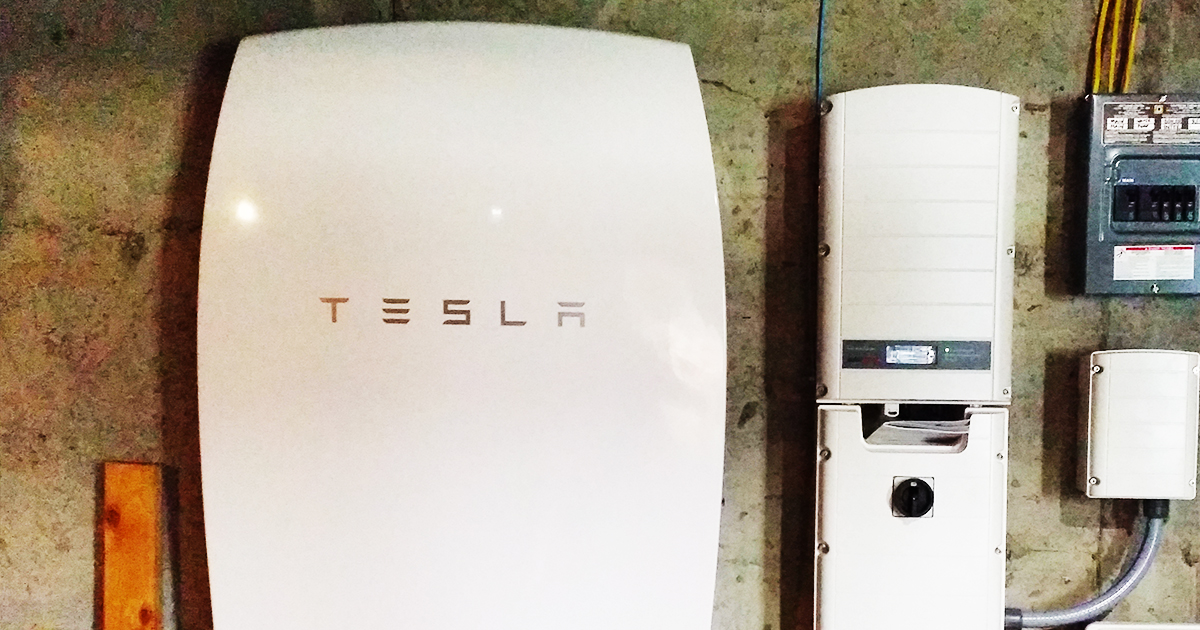

So, to take advantage of the 30% tax credit, installers must configure the battery as well as the inverter, wiring, and associated software to ensure that it only charges from the solar power system.

Happily, this configuration also allows the highest-value uses of solar + storage for homeowners, including backup during a grid outage as well as increased profitability for solar in certain jurisdictions.

Not 100% Certain

However, there is another asterisk both installers and homeowners should be aware of. The IRS letter officially applies only to a single case — a married couple who inquired whether their battery retrofit was eligible for the solar tax credit.

The IRS published its response because it clearly has relevance to homeowners in a similar situation, but it was also required by law to include a disclaimer: “This ruling is directed only to the taxpayer who requested it. Section 6110(k)(3) of the Code provides it may not be used or cited as precedent.”

So, while the letter is certainly a positive development and provides more explicit guidance about what kinds of battery installations are likely to be looked upon favorably by the IRS, installers cannot yet guarantee the credit’s availability for a specific installation. As with the solar tax credit more generally, homeowners should consult with a tax professional before filing.

Expanding Home Energy Market

With well over 1 million solar homes across America, the ability to add batteries to existing systems and claim a 30% tax credit is a huge opportunity. And considering the potential headwinds of the #TrumpTariffs, this is an especially important growth market for the solar industry right now.

Installers that can explain the potential value of these tax credits, along with the attendant asterisks, will have a leg up on their competitors.

Being able to offer streamlined, easy-to-use loan products for both solar and battery systems is a major competitive advantage.